Modified internal rate of return (MIRR) is a similar technique to IRR. Unlike IRR, it is easier to calculate, finds only one value, and resolve some problems with the IRR. It's an alternative measure to evaluate an investment. This free online tools helps to calculate MIRR and supports batch data load.

(Enter/paste: initial investment, finance rate, reinvestment rate, separate with commas, followed by yearly cash-in, SPACE, and cash-out. Separate each year with commas)

| Year | Cash-In ($) | Cash-Out/ Investment ($, minus) | Net Cash Flow ($) |

|---|---|---|---|

| {{$index + 1}} | |||

| Total: |

Using the Modified Internal Rate of return (MIRR) calculator

This MIRR calculation tool will gather information about an investment (or proposing investment), including its initial investment, cash flows, finance rate and reinvestment rate, to calculate the MIRR.

- What is Internal Rate of Return (IRR) - IRR is the rate that makes NPV equal to zero in an investment.

- What is initial investment - It is initial investment at the beginning of the first year.

- What is finance rate - The interest rate you pay for the money used in the cash flows.

- What is reinvestment rate - The interest rate you receive on the cash flows as you reinvest them.

- Cash-In - Annual cash in-flows.

- Cash-Out - Annual cash out-flows.

- Net Cash Flow - Cash-in minus cash-out. If cash-in is greater than cash-out, the net cash flow is positive. Otherwise it is negative.

What is MIRR (Modified Internal Rate of Return)

MIRR is the modification of IRR, and aims to resolve some problems with the IRR. Like IRR, MIRR is also a financial measure of an investment's attractiveness. MIRR assumes that reinvest rate may be different with your financing rate, so reflects cost and profitability of a project more accurately.

Why MIRR

MIRR tries to resolve problems of IRR. IRR has at least two problems. One is in an investment, multiple IRRs could exist. This occurs in a non-conventional cash flow situation which net cash flows change direction several times in a measurement duration. The following table is an example. Cash flows are non-normal and it has more than one IRRs. One is 5.22%, and another is 72.4%. From the following chart, we can see NPV line has cross $0 twice at discounted rate 5.22% and 72.4%.

If there are multiple IRRs, which one to use to measure the investment return?

| Year | 0 | 1 | 2 | 3 | 4 | 5 |

| Cash flows | -16,000 | 16,000 | 16,000 | 15,000 | 15,000 | -50,000 |

Another problem is that IRR doesn't assume reinvestment of net cash in-flows. MIRR assumes that positive net cash flows will be reinvested at a rate that is different from the financing rate. In other words, if reinvestment rate is equal to financing rate, MIRR and IRR will be equal.

MIRR finds only one value.

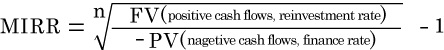

How to calculate MIRR

MIRR is calculated with the fomula:

MIRR = (Future value of all positive cash flows at the reinvestment rate) / (Present value of all negative cash flows at the financing rate) ^ (1/n) - 1

| Year | Cash flows | FV of positive cash flows Reinvestment rate: 5.5% | PV of negative cash flows Finance rate: 3.5% |

|---|---|---|---|

| 0 | -85,000 | -85,000 | |

| 1 | 20,000 | 24,776 | |

| 2 | 20,000 | 23,484 | |

| 3 | -12,000 | -10,823 | |

| 4 | 30,000 | 31,650 | |

| 5 | 30,000 | 30,000 | |

| Total: | 109,910 | -95,823 |

MIRR = (109910/95823)^(1/5)-1 = 2.78%