Printing checks at home or in a small office can save time and money, especially for individuals and businesses with low to moderate check-writing needs. With the right tools and methods, you can create professional-looking checks securely and efficiently. Here's a step-by-step guide to printing checks in-house:

1. Purchase Check Stock:

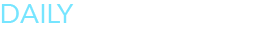

Buying check stock is the first step in printing checks. You can order check stock online, which offers several advantages. Online suppliers provide check paper with built-in security features such as watermarks, microprinting, and chemical alteration indicators. Additionally, the paper is pre-printed with MICR (Magnetic Ink Character Recognition) encoding, which is essential for automated processing by banks. While the cost of check stock is reasonable, it provides added security and authenticity to your checks.

These checks pre-printed with MICR encoding are compatible with almost any printers

These blanks checks need MICR compatible printer

2. Choose a Printing Software:

Selecting the right printing software is crucial for creating and printing checks. While dedicated check printing software like QuickBooks or Quicken is available, users can also utilize popular word processing software such as Microsoft Word or Google Docs. These programs offer flexibility in designing check templates and are familiar to many users. Regardless of the software chosen, ensure that it supports MICR encoding and allows customization of check layouts.

3. Printer Selection:

When it comes to printers, both laser and inkjet printers can be used for check printing. While MICR-compatible printers are available, they tend to be costly and may not be necessary for home or small office use. A standard laser or inkjet printer can produce high-quality checks, provided that it is capable of handling the check stock and MICR ink. Ensure that the printer is in good working condition and properly maintained for optimal results.

4. Generate a Printing Template:

With the chosen software, printer, and check stock, generate a printing template for your checks. This process may require some trial and error to ensure that the layout aligns correctly with the pre-printed MICR encoding on the check stock. Include essential elements such as payee information, amount, date, and memo line. Once the template is finalized, it can be saved and reused for future check printing, saving time and effort.

5. Record Keeping:

After printing a check, it's essential to maintain accurate record-keeping for financial tracking and reconciliation. Record the details of each issued check in your accounting software or ledger, including the payee, amount, date, and purpose of the payment. This information helps maintain transparency and accountability in your financial transactions.

By following these steps, printing checks at home or in a small office can be a straightforward and cost-effective process. With the right equipment, software, and attention to detail, you can produce professional-quality checks that meet the security standards required for banking transactions.

Bonus: What is MICR?

MICR, which stands for Magnetic Ink Character Recognition, is a technology used in the banking industry for processing checks. The MICR encoding consists of a series of characters printed in magnetic ink at the bottom of the check, typically in the form of a special line known as the MICR line.

The MICR line contains three sets of information:

1. Routing Number: This nine-digit number identifies the bank where the account is held. It helps in routing the check to the correct financial institution for processing.

2. Account Number: The account number uniquely identifies the specific account within the bank. It helps in identifying the account to which funds should be withdrawn or deposited.

3. Check Number: The check number is a sequential number assigned to each individual check within a checkbook. It helps in tracking the order of checks issued from the account.

The use of magnetic ink and a specific font called E-13B is essential for MICR encoding. The characters printed with magnetic ink can be magnetized and read by MICR readers and sorting machines used by banks and financial institutions. This enables automated processing of checks, allowing for faster and more efficient handling of large volumes of checks.

MICR technology provides several benefits, including:

- Accuracy: MICR characters are highly legible and resistant to smudging or fading, ensuring accurate data capture during processing.

- Security: The use of magnetic ink and specialized printing techniques adds an extra layer of security, making it difficult to alter or counterfeit checks.

- Efficiency: Automated MICR readers and sorting machines can process checks quickly and accurately, reducing processing times and costs for banks and businesses.