Nettobarwert Rechner

Nettobarwert ist einer der am meisten verwendeten Maßnahmen zur Beurteilung einer Investition. Eine Anlage mit einer höheren Kapitalwert als profitabler als Investition mit niedrigeren Barwerts berücksichtigt. Das kostenlose Online-Tool hilft Ihnen, NPV berechnen. Sie benötigen Zahlungsströme des jeweiligen Zeitraums und Diskontsatz auf der Hand, bevor Sie die Berechnung.

| Jahr | Cashflow In ($) | Cashflow Out ($, minus) | Netto-Cashflow ($) | Discounted Cashflow ($) |

|---|---|---|---|---|

| {{$index + 1}} | ||||

| gesamt: |

How to use this net present value (NPV) calculator

- NPV - Net present value. If NPV>0, the project might be acceptable. If NPV<0, the project should be rejected.

- Discount rate - the rate of return that could be realized on an investment in the financial markets with similar risk. e.g. interest rate.

- Initial Investment - Initial investment during the first year.

- Cash-In - Annual cash in-flows.

- Cash-Out - Annual cash out-flows.

- Net Cash Flow - Cash-in minus cash-out.

- Discounted Cash Flow - A future cash flow is estimated and discounted to give its present value.

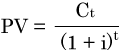

What is PV(present value)

To better understand NPV(net present value), let's first look at what is present value(PV). PV is the current worth of a future amount of money. "A dollar today is worth more than a dollar tomorrow", this is referred to as the time value of money. A given amount of money today has different (usually higher or equal) buying power than the same amount of money in the future. In finance and investment, PV is used to evaluate the future cash flows.

PV formula

What is discount rate

Discount rate is a key factor to calculate present value of future cash flows properly. The higher the discount rate, the lower the present value of the future cash flows. Typically 7% - 10% is a good range for most projects in today’s market conditions.

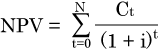

What is net present value (NPV) and how to calculate NPV

NPV is the sum of the present value(PV) of the future individual cash flows (including in flows and out flows).

NPV formula:

Here is an example, let’s use NPV to evaluate a 5-years project: Initial investment at year 0 is $100,000, discount rate is 5% annually. Annually profit from the end of the first year to the end of the fifth year is:

- $20,000

- $30,000

- $30,000

- $30,000

- $25,000

Then the PV of each year is:

- Year 0: -100,000

- Year 1: 20,000/(1+0.05) = 19047.62

- Year 2: 30,000/(1+0.05)^2 = 27210.88

- Year 3: 30,000/(1+0.05)^3 – 5,000/(1+0.05)^3 = 21595.94

- Year 4: 30,000/(1+0.05)^4 = 24681.07

- Year 5: 25,000/(1+0.05)^5 = 19588.15

NPV = 12123.67

NPV and IRR

NPV tells how much value an investment or project will bring in.

If NPV > 0, the investment may be accepted.

If NPV < 0, The investment should be rejected.

Using NPV to determine an investment is certainly not enough. IRR (internal rate of return) will tell you the other side of the story. It gives you the rate of return, so can be used to compare different investments.

Calculate NPV in Microsoft Excel

If you don't have internet access or are more comfortable to work with Microsoft Excel, this tutorial video will teach you how to do it in Excel.