Harnessing the Power of Internal Rate of Return (IRR): A Comprehensive Tool

Internal Rate of Return stands as a paramount metric for evaluating investments. Investments boasting higher internal rates of return are deemed more lucrative than those with lower rates. This online tool empowers you to calculate IRR effortlessly, accompanied by a dynamic chart illustrating the correlation between Net Present Value (NPV) and discount rate.

(Enter/paste: initial investment, COMMA, followed by yearly cash-in, SPACE, and cash-out. Separate each year with commas)

| Year | Cash-In ($) | Cash-Out/ Investment ($, negative) | Net Cash Flow ($) |

|---|---|---|---|

| {{$index + 1}} | |||

| Total: |

Unveiling the Result and Chart for Internal Rate of Return (IRR)

Utilizing the Internal Rate of Return (IRR) Calculator

- Internal Rate of Return (IRR) - IRR denotes the rate at which the Net Present Value (NPV) equals zero in an investment.

- Initial Investment - The primary capital outlay at the inception of the investment.

- Cash-In - Annual cash inflows generated by the investment.

- Cash-Out - Annual cash outflows or expenses associated with the investment.

- Net Cash Flow - The difference between cash inflows and outflows.

Understanding IRR (Internal Rate of Return)

IRR represents the rate of return that renders the Net Present Value (NPV) zero. It is also referred to as the effective interest rate or the rate of return. IRR serves as a key metric for evaluating the viability of an investment or project. Typically, higher IRR values indicate greater potential for project acceptance.

How to Calculate IRR?

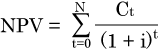

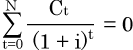

Discussing IRR without mentioning NPV is virtually impossible. The NPV formula is as follows:

Since IRR is the rate at which NPV equals zero, we derive the following expressions:

or

PV of benefits - PV of costs = 0

Where i represents IRR, the sole unknown variable, solvable using numerical or graphical analysis techniques.

Let's consider an example:

An $85,000 investment yields $20,000 annually over a 5-year period. What is the rate of return on the investment?

Solution:

20000/(1+i) + 20000/(1+i)^2 + 20000/(1+i)^3 + 20000/(1+i)^4 + 20000/(1+i)^5 = 85000

The IRR is 5.68%.

IRR vs NPV

IRR represents a percentage rate, whereas NPV denotes an absolute value. IRR is commonly utilized to assess the profitability of an investment or project. If the IRR exceeds the cost of capital, the investment or project is often deemed acceptable; otherwise, it may be rejected. NPV measures the total value that an investment will generate during a specified period. A positive NPV generally indicates the investment's acceptability.

Calculating IRR in Microsoft Excel

If you prefer working with Microsoft Excel or lack internet access, this tutorial video will guide you through the process of calculating IRR using Excel.